PRINCIPLES RELATING TO WORKS INVOICES

Chorus Pro allows the transmission of documents for the execution of works contracts during and at the end of the contact in accordance with the CCAG travaux (general conditions of works contracts).

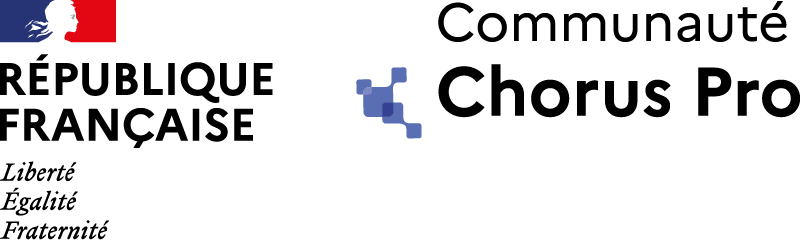

Several types of contributors are involved in the management process :

- Suppliers (contracting party, joint contractor, subcontractor)

- Project management (MOE)

- Authorizing officer : Contracting authority (MOA) and/or financial service

The transmission mode depends on the invoicing framework

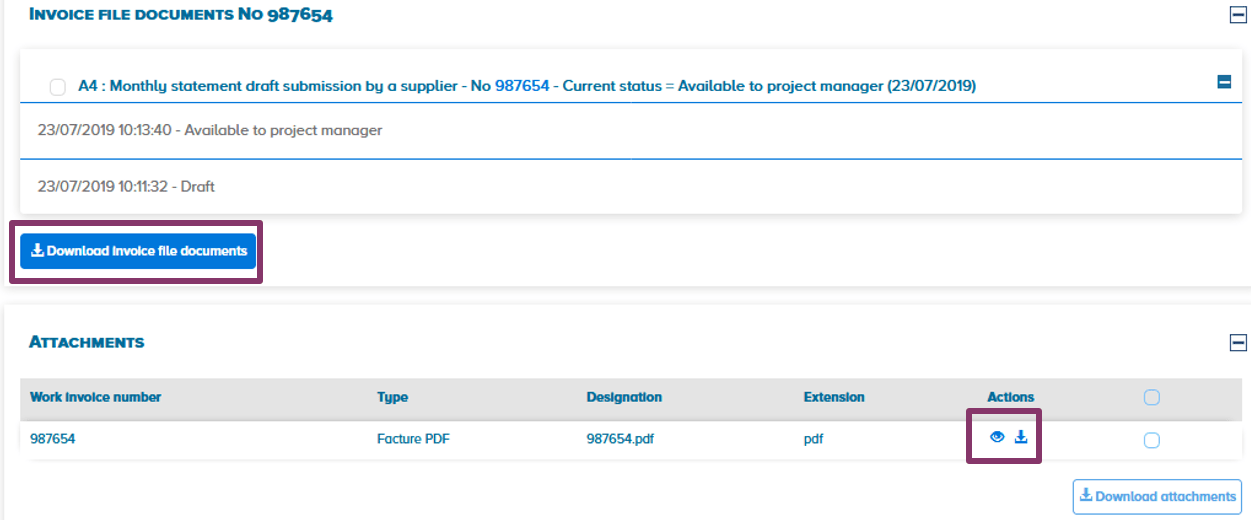

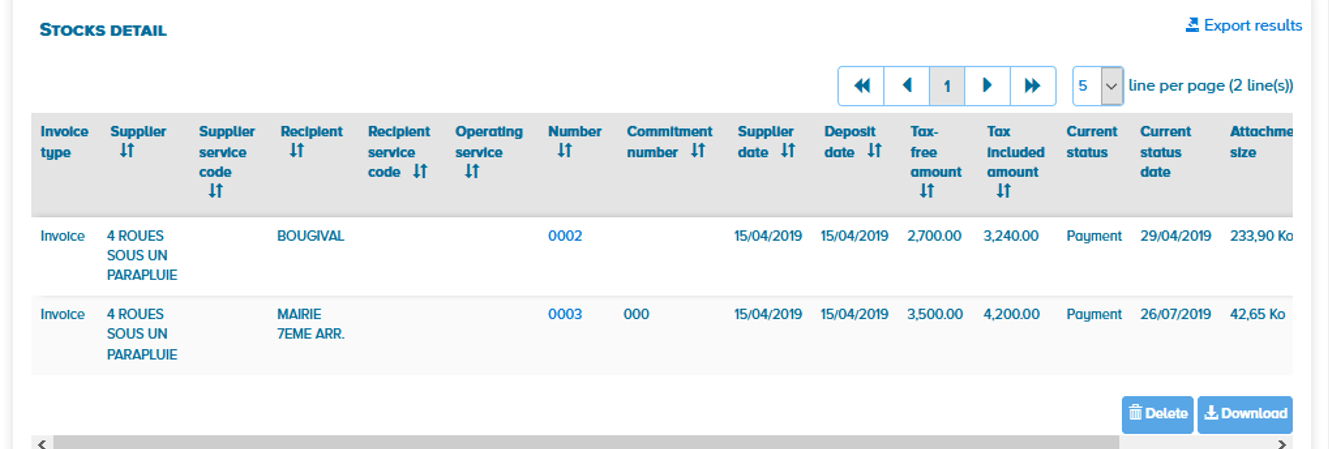

The invoice file includes all documents submitted by contributors to the invoicing process for every monthly or final invoicing. For each payment request, an invoice file available to the supplier, the project manager or the contracting authority is created. Whenever a contributor to the process submits his documents, they are automatically added to the "invoice file", which thus becomes a compendium of all exchanged documents for any given invoicing cycle.

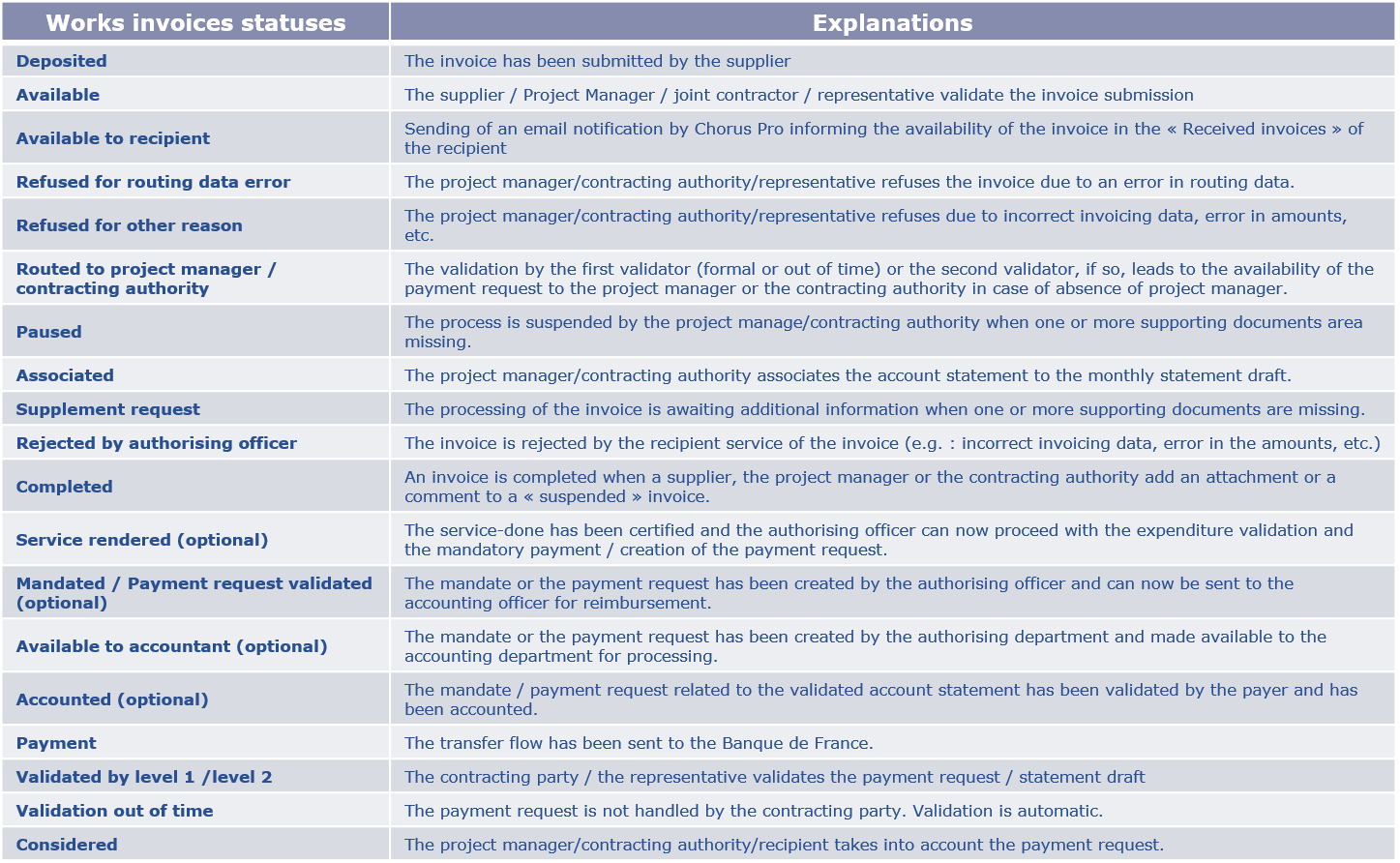

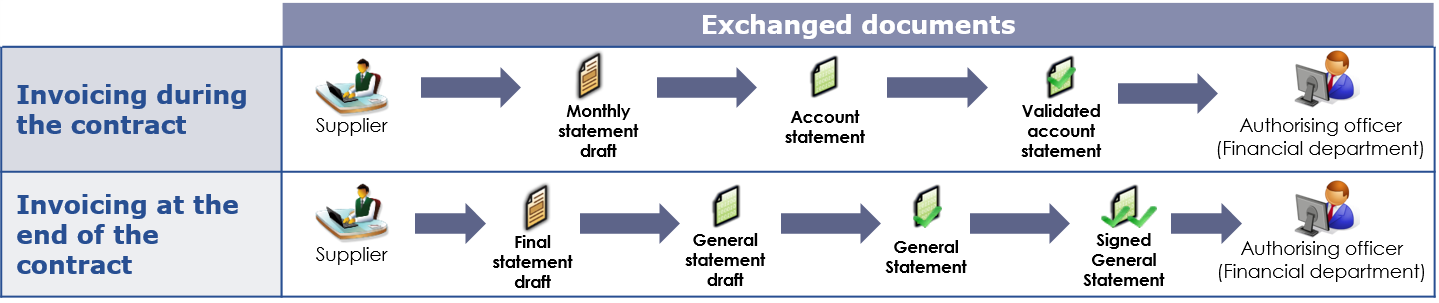

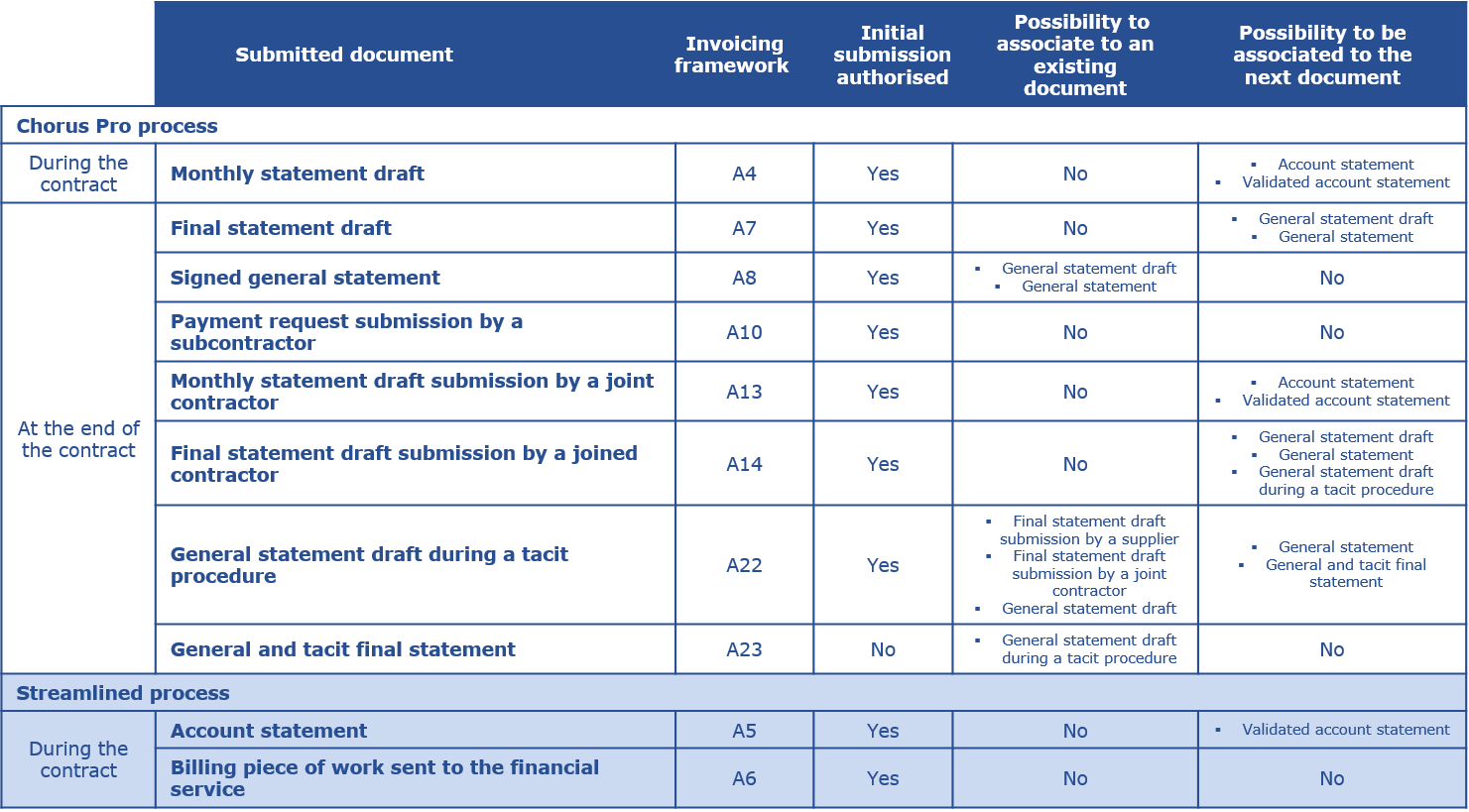

The documents submitted by each contributor differ according to the progress of the contract :

The transmission of documents in Chorus Pro can be done in two ways :

- Without reference to an existing document (initial submission). In this case, a new invoice file is created.

- By referring to a previously transmitted document (association). It is automatically associated with the same invoice file.

If the project manager has not processed the « monthly statement draft » within 7 days, the submitting supplier and the receiving Authorizing officer may receive notifications that there is no action on the document.

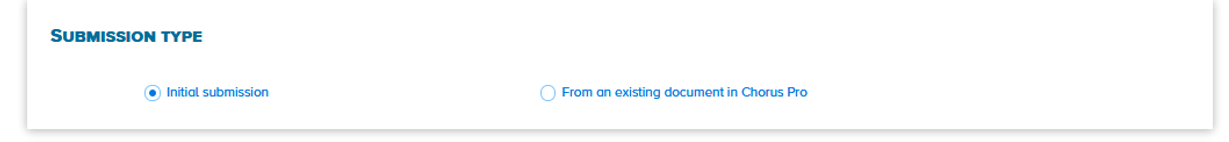

The invoicing framework allows to identify the submitted document as well as the contributor in charge of the submission. This information is indicated in for each submitted document.

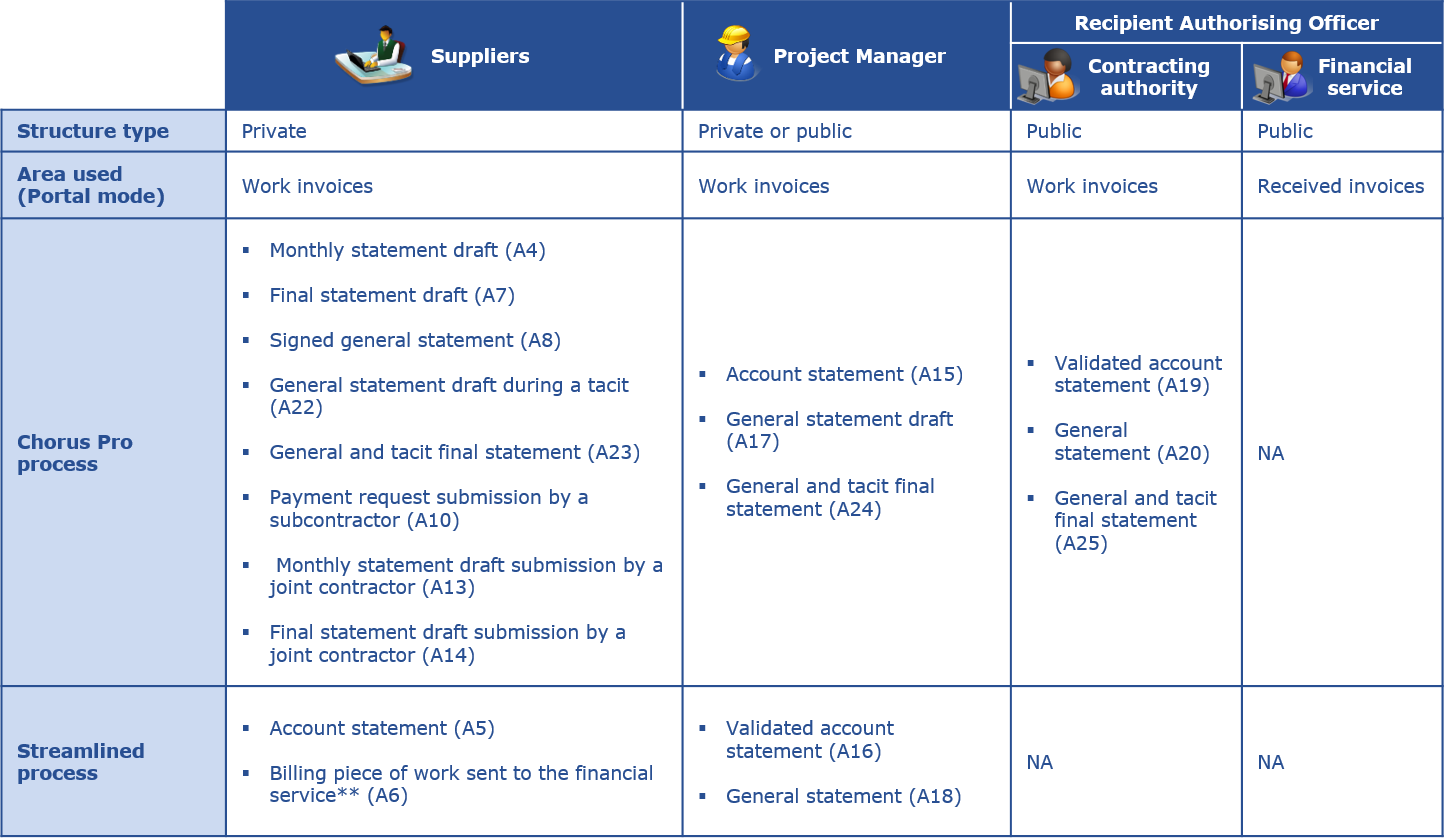

Works invoices can be submitted according to 3 possible modes via Chorus Pro (EDI, PDF submission in Portal or Service mode); however the 3 modes do not cover all the invoicing frameworks :

- The EDI mode can only be used by the supplier (subcontractor, joint contractor, contracting party or representative) and when creating an invoice file. This mode does not allow the "association" of documents and thus their addition into the invoice file.

- Portal and service modes (API) cover the entire scope of the “Work invoices" functionality.

Please refer to the details regarding the transmission modes accepted by each invoicing framework in the table in the appendix.

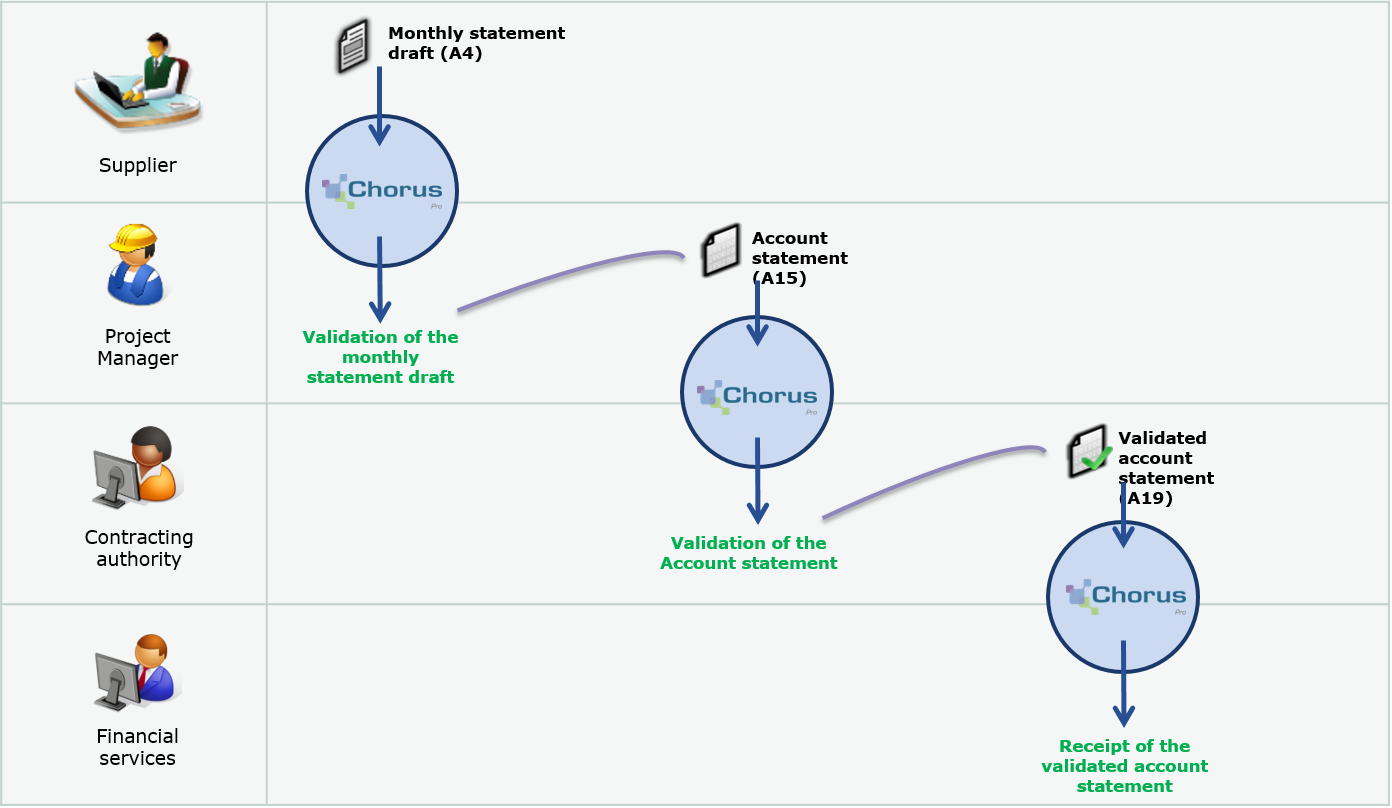

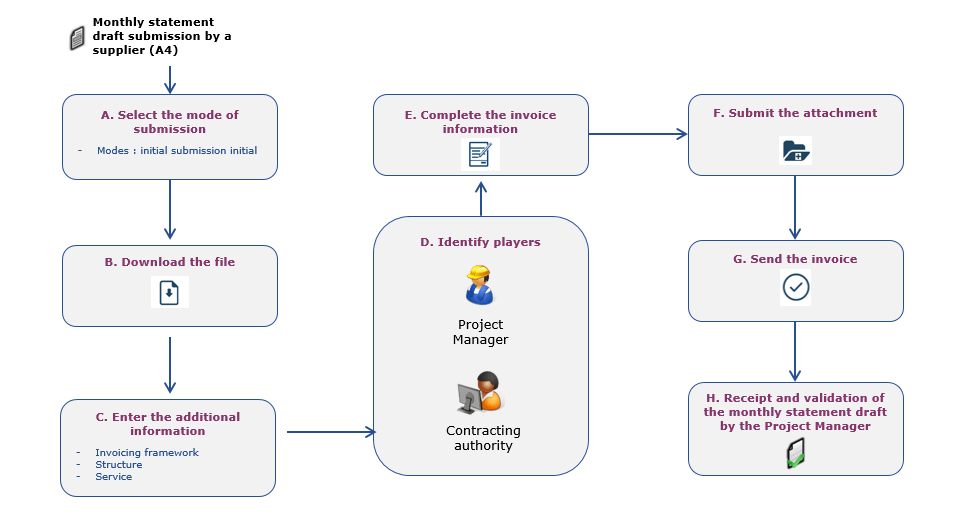

Below is the nominal process for transmitting an invoice in Chorus Pro during the contract :

Below is the nominal process for transmitting an invoice in Chorus Pro at the end the contract :

Given the Chorus Pro deployment schedule (up to 2020 depending on the size of the company), all players of the invoicing process may not be in Chorus Pro.

The submission streamlined process allows to use Chorus Pro even if the project manager or the contracting authority are not registered on the portal. The use of this alternative must however be the subject of prior agreement between all stakeholders (contracting party, subcontractor, project manager, contracting authority.

Two possible cases may be encountered on Chorus Pro :

1. A contributor may directly submit a document validated by another player on the basis of prior exchanges outside of Chorus Pro.

During the market :

- The supplier can submit the account statement instead of the project manager (A15)

- The project manager can submit the validated account statement instead of the contracting authority (A19)

At the end of the market :

- The provider can submit directly the signed general statement (A8)

2. Public entities, depending on their organisations, may decide not to identify the contracting authority in Chorus Pro.

In this event, the supplier will submit his monthly statement draft with an invoicing framework A6 (Billing piece of work sent to the financial service).

The document arrives :

- Either directly to the financial service of the public entity in the “Received invoices” area of Chorus Pro (receipt in portal mode)

- Or in the invoice management application (receipt in EDI/API mode).

The public entity is then in charge of obtaining the validation of the project manager and the contracting authority outside the tool.

Before submitting an invoice in Chorus Pro, with the contracting authority the invoicing circuit of the contract . You can use the contract identity sheet to identify players and the invoicing frameworks to be used. This document is available a the following address : https://communaute.chorus-pro.gouv.fr

In order to regulate the contractual deadlines for the production of works documents, the "CCAG Travaux" provides under articles 13.4.4 and 13;4;5 that :

- If the contracting authority has not processed the general statement draft sent by the project manager within the time limits, the supplier submits to the contracting authority a general statement draft during a tacit procedure (A22*). Without a feedback from the contracting authority on time, the supplier can submit a general and tacit final statement (A23*).

- If the supplier has not returned the general statement sent by the contracting authority signed (with or without reservation) on time, the contracting authority can submit a signed general statement which has become final (A25*) for transmission to the final service of the public structure. In the event the contracting authority is not in Chorus Pro, the project manager can submit the general and tacit final statement using the A24 invoicing framework.

*invoicing framework to be used for the transmission of these documents

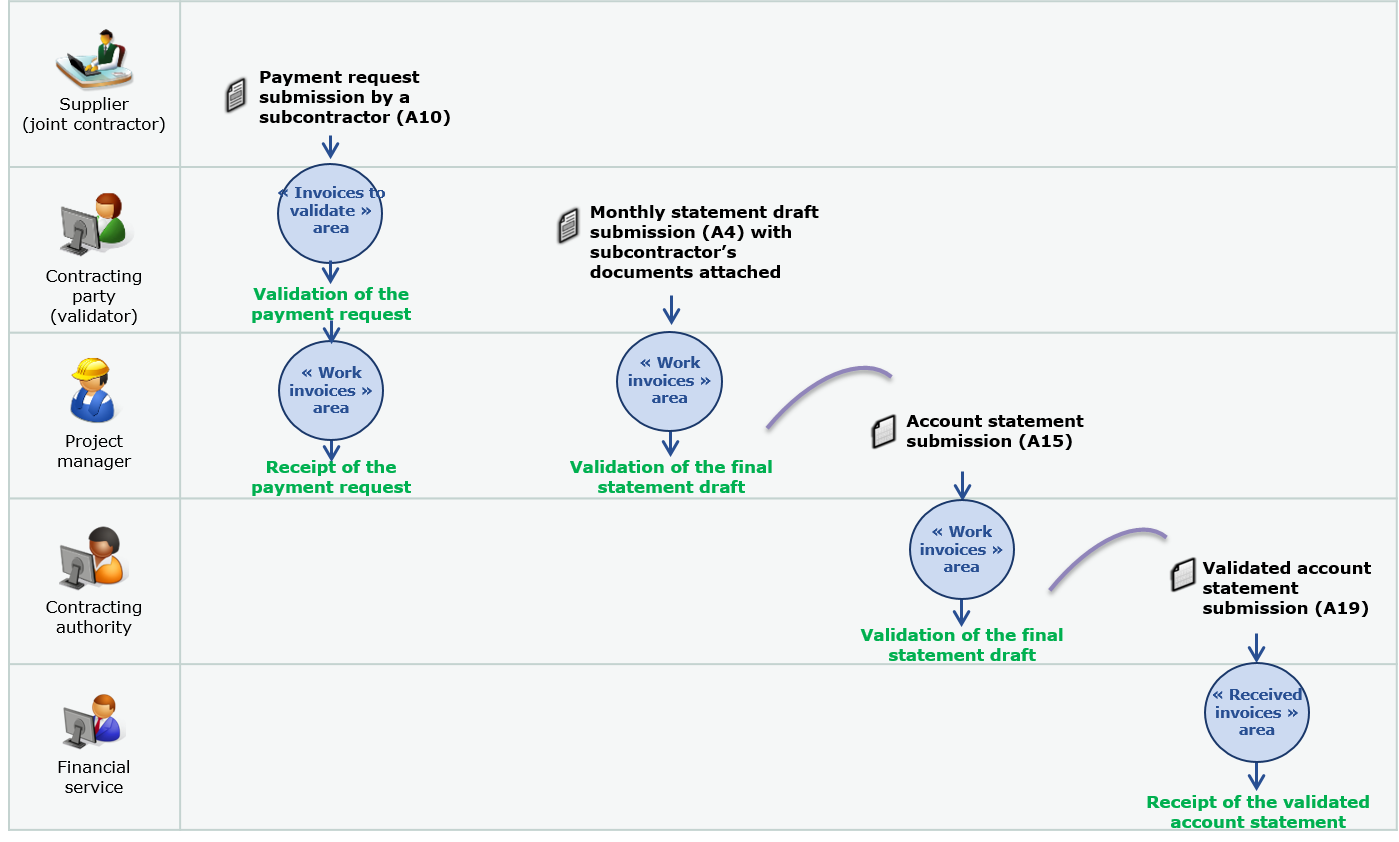

Where the subcontractor of a contracting party is eligible for direct payment, it may be paid directly by the public body for part of the contract he executes. Validation by the contracting party is nevertheless required.

Applicable principles :

- The subcontractor sends a payment request via Chorus Pro for the services he is in charge of (invoicing framework A10). The contracting authority has 15 days to process it.

- In the context of works contracts, in accordance with article 13.5.1 of the CCAG Marchés de travaux (GCC works contracts), the project manager receives the subcontractor’s payment request.

- Chorus Pro notifies by email the contracting authority of the issue of a payment request from a subcontractor.

- In all cases (acceptance, refusal or non-intervention from the contracting party within 15 days), the request is forwarded to the project manager.

To process a payment request, the contracting party can refer to the documentation "Manage subcontracting, co-contracting invoices"available on the Chorus Pro Community.

Submission of a subcontracting invoice in Chorus Pro

In the context of works contracts, the joint contractor submits a request for payment for validation by the representative (invoicing framework A13, A14).

Once the validation is done, the project manager accepts or edit the monthly statement draft which he sends as an attachment to his account statement. In other words, the invoicing process takes place as described in the CCAG travaux.

In case of refusal by the representative the process stops.

Each joint contractor submits his own invoices in Chorus Pro, the concept of enterprise grouping does not exists in the application.

Submission of a co-contracting invoice in Chorus Pro

The use of Chorus Pro for works contracts requires :

- The creation of a user account

- The creation of a structure (if it does not already exist), in other words, the identification of the SIRET of the company (or alternative ID for foreign companies) submitting the document in the tool. Each player must submit his documents under his own structure.

- The access to the “Work invoices” area

- The choice of one of the 3 transmission modes :

- The Portal mode provides suppliers with a free access dedicated to the entry and the submission of invoices

- The Service mode (API) allows to integrate Portal services into the supplier’s information system

- The EDI mode allows the exchange of information through standardised format flows between information systems.

To know more about these concepts, please refer to the user guides available at : https://communaute.chorus-pro.gouv.fr

SUBMIT AN INVOICING DOCUMENT

The submission of a works invoice in Chorus Pro follows the path below :

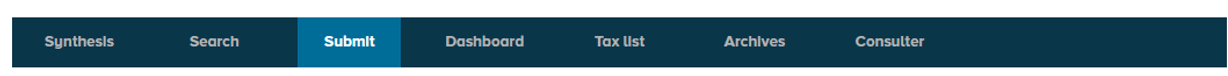

From the « Work invoices » area, click on the « Submit » tab :

Check « Initial submission » to submit the first billing document :

Select the file you want to import clicking on![]()

- Select the appropriate invoicing framework from the drop-down list

- Specify your structure

- If you have set up services on your structure, select one.

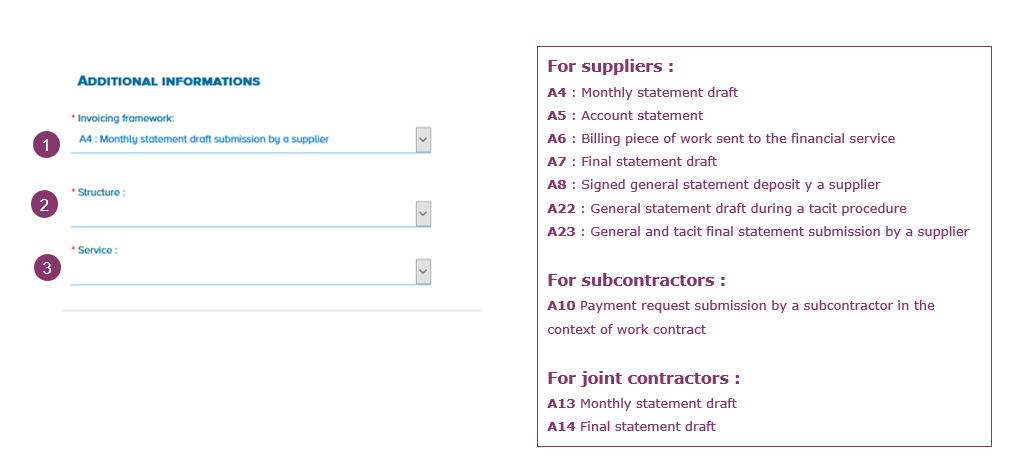

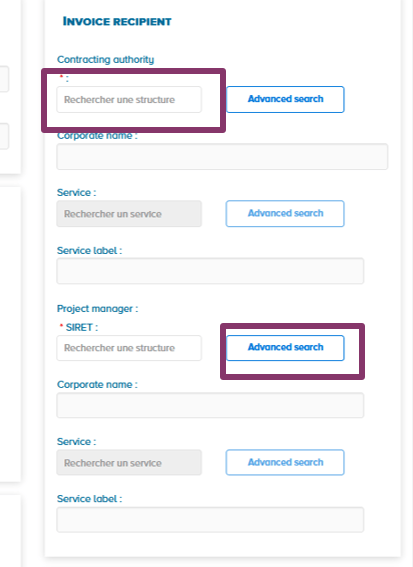

Identify the Project Manager and the Contracting Authority. To do so, type directly the SIRET number (or alternative ID, for foreign companies) or click on the « Advanced Search » button.

Enter one or more search criteria such as the company name, the SIRET number, the city…

Validate your choice and select the structure from the results.

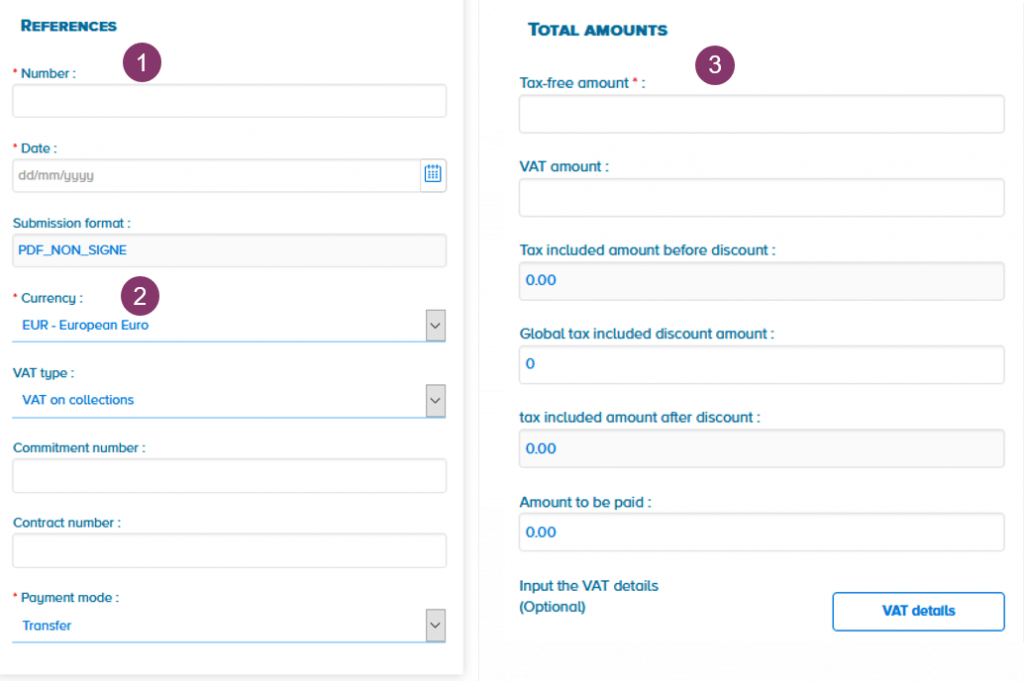

1. Fill in the identification number and the date of invoice.

2. Select the currency and the VAT type. In case of VAT reverse charge, choose option « Without VAT ».

3. Fill in the total amounts of your invoice

4. I you wish, you can enter different lines per VAT rate in the « VAT summary » section. This data is not mandatory; detail of your invoice will be specified in the PDF downloaded and its attachments.

5. Save the invoice

Once you save the invoice, controls are carried out by Chorus Pro. You are then alerted in cases where :

- A required field is missing on the invoice

- The project manager did not activate the « Work invoices » area to be able to receive your invoice.

![]()

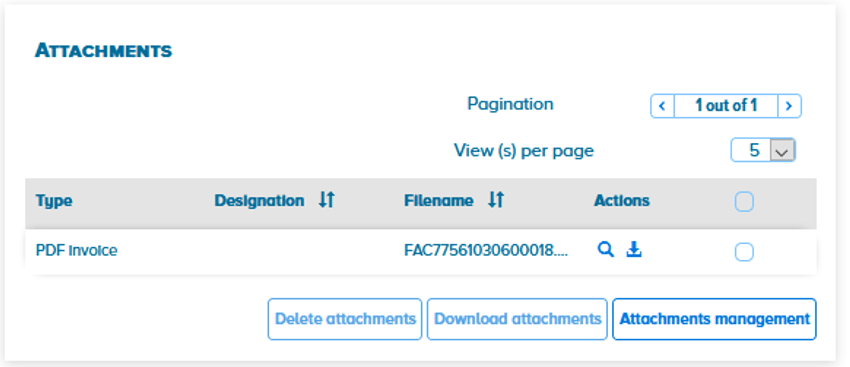

You can :

Delete one or more attachments

Delete one or more attachments

![]() Download one or more attachments

Download one or more attachments

![]() Add an attachment

Add an attachment

![]() View, download an attachment

View, download an attachment

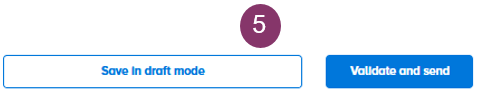

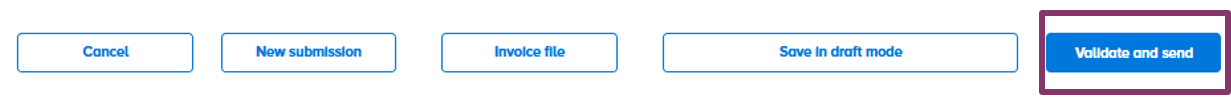

Click on « Validate and send » :

A window appears. Confirm the sending of your works invoice by clicking on « Confirm and send ».

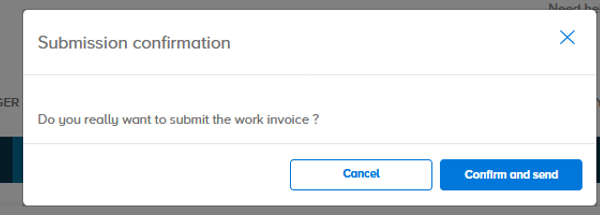

An invoice file is then created allowing the other contributors to associate their documents. It is up to you to track the progress of its processing.

If the project manager has not processed the « monthly statement draft » within 7 days, the submitting supplier and the receiving Authorizing officer may receive notifications that there is no action on the document.

You can then export the export submission certificate and, if you wish, go back into the invoice file :

You will be notified by email of the change of status made on your invoice (ex : available, refused, paused) and of the submission of a new document in the invoice file.

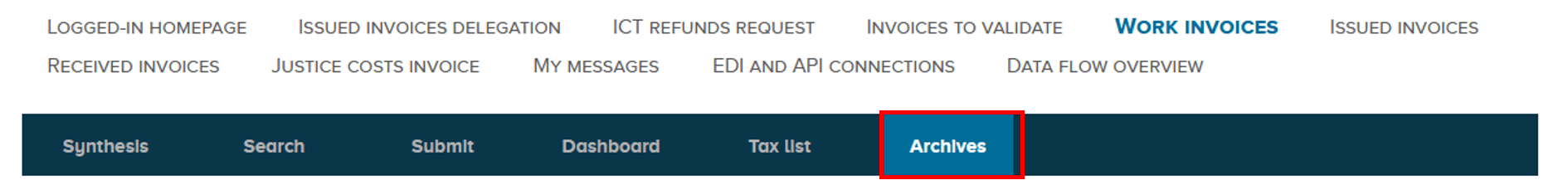

"WORK INVOICES" : OTHER FEATURES

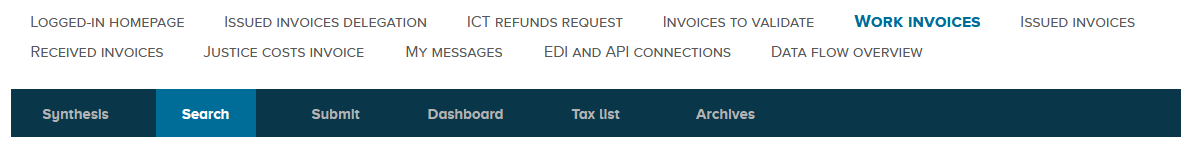

From the homepage, access the « Work invoices » area :

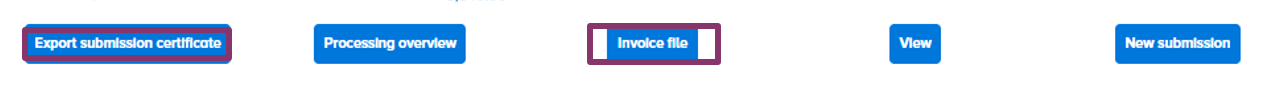

Chorus Pro provides you other features allowing the processing, tracking and search of your invoices :

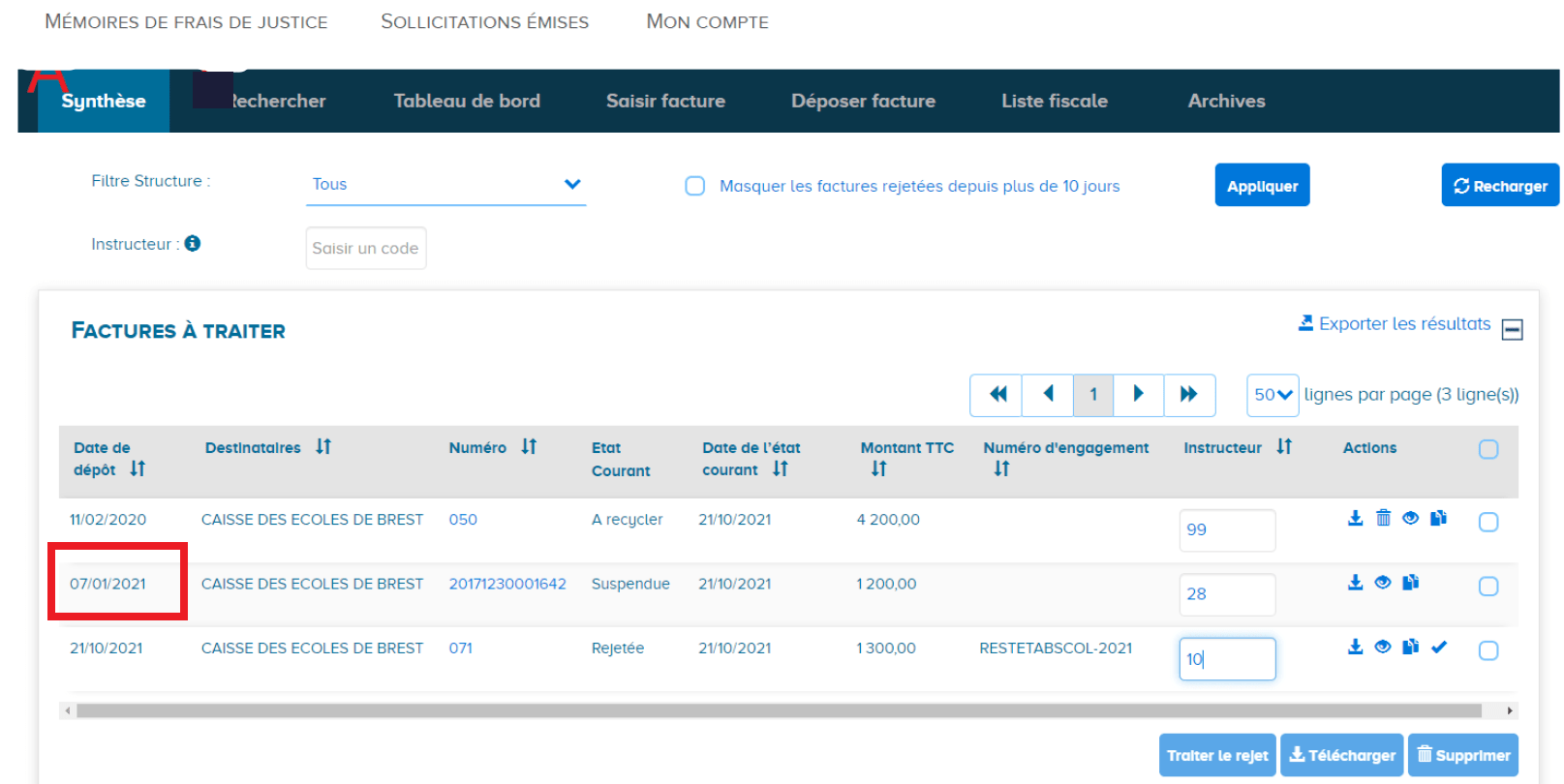

The « Synthesis » tab : indicates invoices requiring action from your part

The « Search » tab : search for invoices according to different criteria(number, date, …)

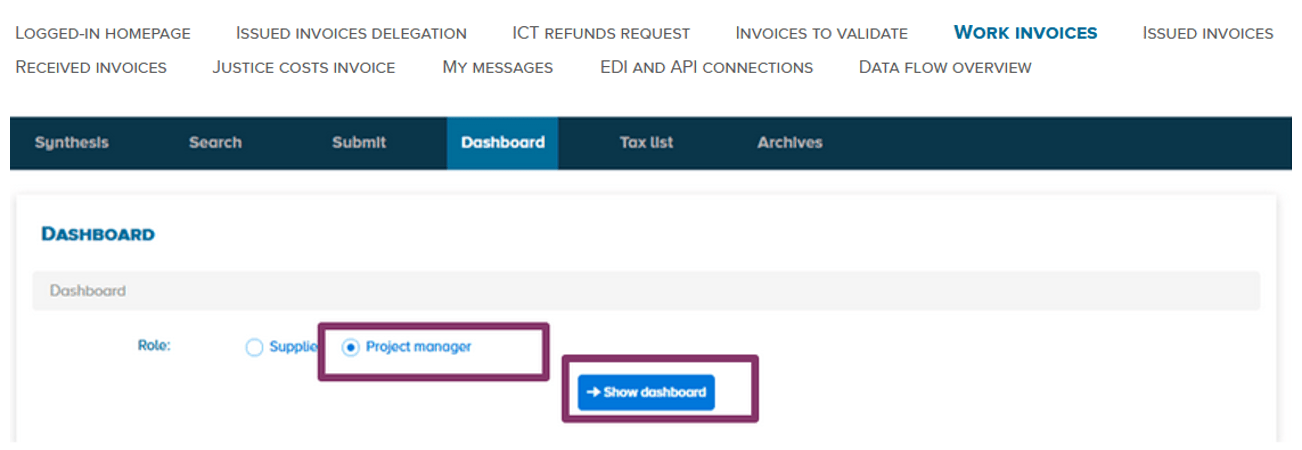

The « Dashboard » : search for invoices by status

The « Tax list » : consultation and export of the invoices tax list

The « Archives » tab : search for unmodified invoices for more than two years

As a supplier, in the « Work invoices » area, after clicking on the « Synthesis » tab, you can process an invoice that has been refused or paused by the project manager.

Click on the invoice number to view it.

Several actions are possible :

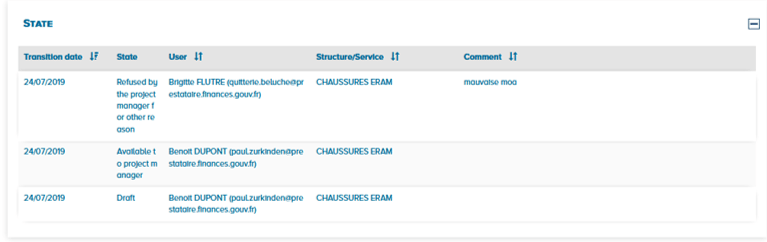

![]() Processing overview to obtain a history of the actions performed on the different documents of the invoice file.

Processing overview to obtain a history of the actions performed on the different documents of the invoice file.

![]() Invoice file to consult the invoices

Invoice file to consult the invoices

![]() Validate and send, after making the necessary changes requested by the recipient

Validate and send, after making the necessary changes requested by the recipient

Manage refusals : routing data error

In case of « Refusal » of his invoice by the project manager, the supplier can re-use the invoice data to facilitate the new sending to Chorus Pro. The refusal is due to an error in the identification of the recipient (incorrect project manager, contracting authority or validator).

You can correct and reissue the original invoice by identifying the recipient while keeping the same invoice number.

- Click on the invoice number from the « Synthesis » tab

- -Correct the recipient structure by searching for the appropriate SIRET

- -Validate and send the invoice

Manage the suspension : missing supporting documents

If one or more supporting documents essential for the mandatory payment or the posting of the invoice are missing, the project manager can suspend your invoice.

You can complete and reissue the original invoice by adding the supplementary attachments while keeping the same invoice number.

- Click on the invoice number from the « Synthesis » tab

- Then add the missing attachments

- Validate and resend the invoice

The invoice changes to the « completed » status.

From the « Work invoices » area, click on the « Search » tab to search for an invoice already processed.

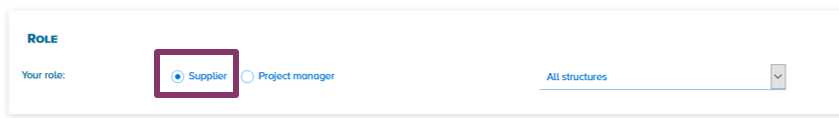

Select the “Supplier” role and, if appropriate, specify the structure and/or the issuing service :

Enter one or more of the following criteria :

- Document type, recipient, invoicing framework, issue date period, current status

- Access the advanced search criteria (invoice tax-fee amount, …) by clicking on

Click on « Search ». The search results are displayed. You can export the results list in XML format by clicking on ![]()

Click on the invoice number to view it. The consultation screen appears reminding you of the invoice items.

Several actions are possible :

![]() Download the invoice in PDF format

Download the invoice in PDF format

![]() View the invoice

View the invoice

![]() Processing overview to obtain a history of the actions performed on the different documents of the invoice file.

Processing overview to obtain a history of the actions performed on the different documents of the invoice file.

![]() Invoice file to consult the invoices

Invoice file to consult the invoices

![]() Export the submission certificate

Export the submission certificate

Click on ![]() Invoice file allows you to get access to all documents of the invoice file related to the invoice.

Invoice file allows you to get access to all documents of the invoice file related to the invoice.

You can :

![]() View an invoice in PDF format

View an invoice in PDF format

![]() Download an invoice

Download an invoice

![]() Download all the documents of the invoice file.

Download all the documents of the invoice file.

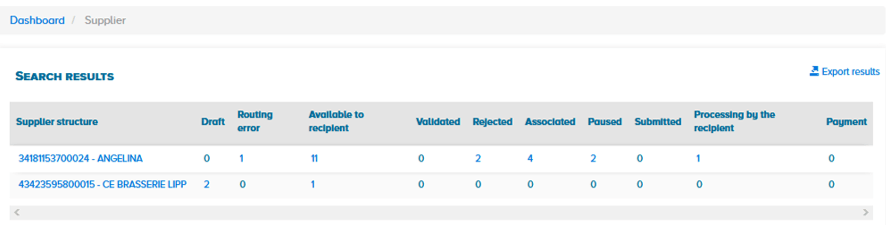

The « Dashboard » tab allows you to find and track the progress of invoice processing according to their status (see details in appendices).

Check « Supplier » and click on « Show dashboard » :

The search results are displayed. You can export this result in XML format by clicking on ![]() :

:

The first level is displayed : by structure

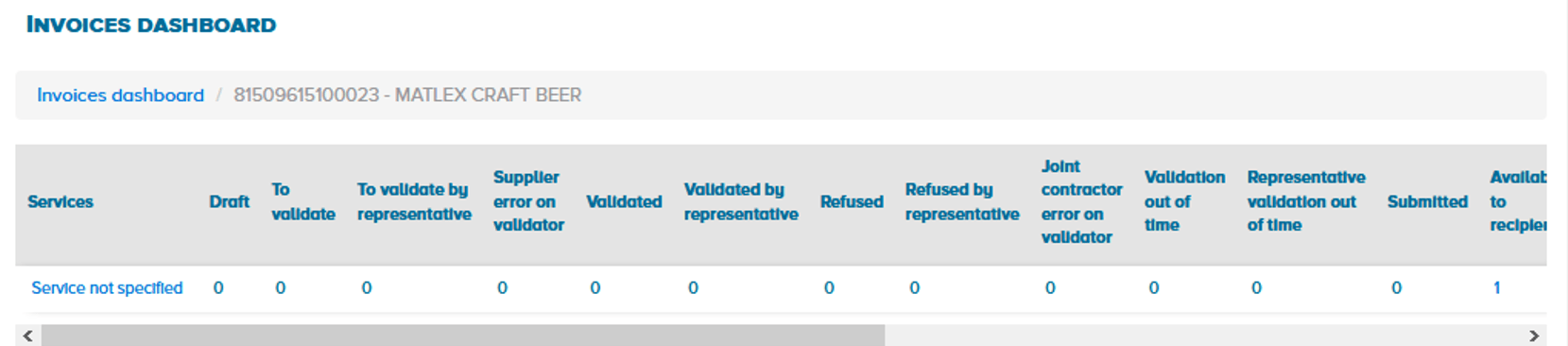

When clicking on the structure name, you will get invoices dispatched by service then by invoicing framework.

Second level: By service

Invoices not related to a service appear on the line called « service not specified ».

Third level: By invoicing framework

Select the number displayed to access the detail (table exportable on Excel) :

You can now consult the tracking of your invoices and check the origin of a transfer received via Claudia.

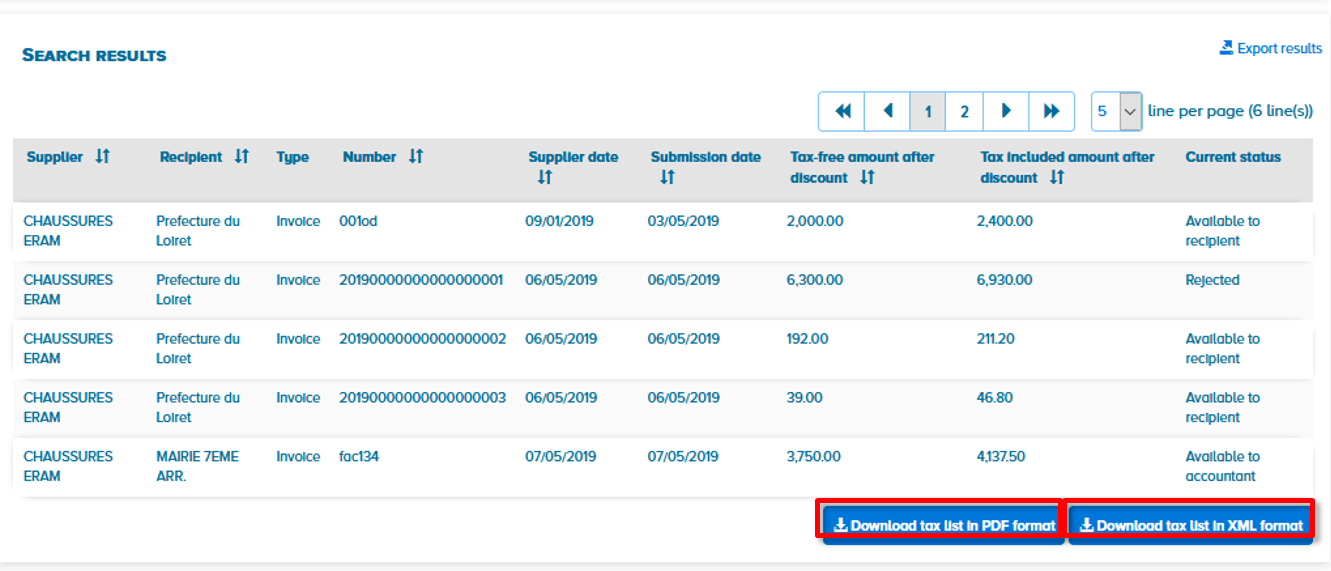

The General tax code requires that invoices sent electronically be kept in a summary list by the companies issuing and receiving invoices. Suppliers using Chorus Pro have this feature.

To access it, click on the « Tax list » tab. The screen below is displayed :

Fill in the search criteria and click on the “Search” button. You can export the results of your search.

Invoices processed for more than 2 years are kept in the « Archives » tab.

The « Archives » tab allows you to select one or more search criteria to find your invoices. The criteria summary section summarizes the selected criteria.

Click on the « Search » or « Reset » button to start again.

APPENDICES

The supplier is identified on all documents of works contracts including when he is not the issuer of the document sent or when he is not part of the invoicing process. The supplier can submit the following documents of the invoice file :

Since early 2024, new interface codes have been created for works invoices. The purpose of this evolution was to split works invoicing from standard invoicing flows (originally, works invoices and standard invoices were sent through the same flows & interface codes). This will in turn ease the development of an improved Chorus Pro module dedicated to works invoices.

The new data flow formats and associated interface codes are the following :

- Structured XML format : FSO1130A (copy of the FSO1100A, but devoted to works invoicing)

- Mixed XML format : FSO1131A (copy of the FSO1110A, but devoted to works invoicing)

- Format PDF/A-3 (Factur-x) : FSO1137A (copy du flux FSO1117A)

As you can see from these details, the flow formats do not change as the structure of each "works" data flow is simply copied from the original formats.

The former data flows (FSO1100A, FSO1110A et FSO1117A) remain active and can still be used both for standard invoices & works invoices. However, if you want to split your "works" invoices from the rest, you can now use the dedicated "works" flows for works invoices, which may prove handy when B2B invoicing and the future "works" module will be launched.

The three new FSO (FSO 1130A, 1131A and 1137A) can now be used in EDI, API and portal mode. If you want to implement them (thus splitting your data flows) in EDI, make sure to update your EDI connection form to "subscribe" to the new formats.

Webinar

Register for the next webinars !

Check out our free webinar "Works invoices for suppliers" which deals with works invoices on Chorus Pro. During this presentation, an advisor from the AIFE will answer your questions (only in french).

Tutorial

Last Update: January 30, 2024