PUBLIC PROCUREMENT : ELECTRONIC INVOICING IS MANDATORY

In the context of the acceleration of digital exchanges between companies and administrations, invoices from suppliers to public sector structures must gradually be dematerialized.

The dematerialization program is in line with the Economic Modernization Act (LME) of 4th August 2018 and represents a further step towards the abolition of paper.

Since January 1st 2012, the State has been obliged to accept electronic invoices from its suppliers.

This obligation has been extended to local authorities and all public institutions from 1st January2017. Issuers of invoices to the public sector are also affected by this obligation with a gradual schedule of transition towards the dematerialization of their invoices.

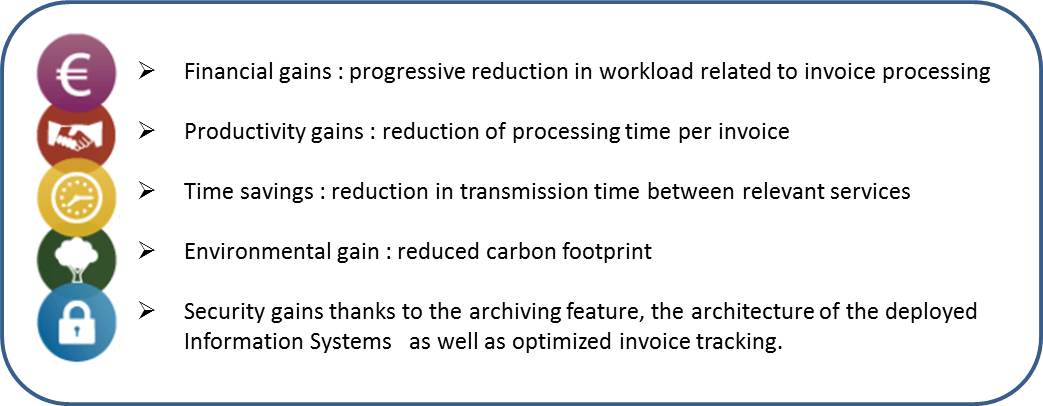

EXPECTED BENEFITS

Dematerialization provides advantages for both companies and administrations :

In addition to these benefits, there are also reduced mailing costs (printing and postage) as well as the elimination of handling paper documents materials and consequently, guaranteed documents delivery.

Dematerialization of invoices can also offer competitive advantage (dematerialization clauses being increasingly present in public markets) and not insignificant marketing advantages (leadership, brand image and reputation).

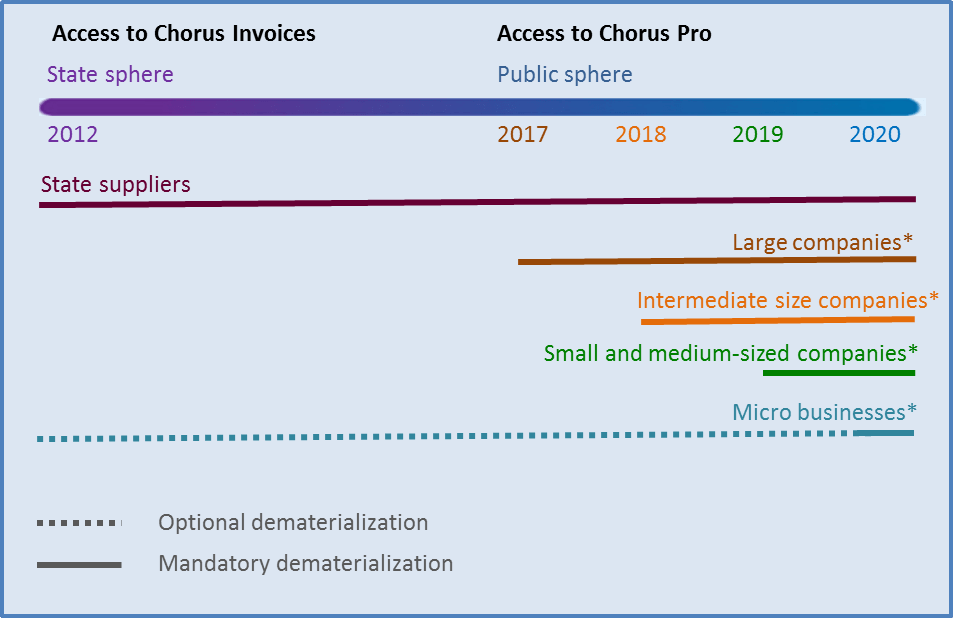

CALENDAR DEADLINES FOR ELECTRONIC INVOICING

Ordinance 2014-697 of 26 June 2014 on the development of electronic invoicing provides for the progressive dematerialization of payment requests for issuers of invoices to the State, local authorities and their respective public institutions.

All invoices issued by suppliers to the public sector will have to be dematerialized by 2020.

The dematerialization deadlines takes into account the size of companies and are as follows :

- From 1st January 2017 : for large companies (+ 5000 employees and turnover > € 1.5 billion) and public persons

- From 1st January 2018 : for intermediate size companies (250 to 5000 employees and turnover > € 1.5 billion)

- From 1st January 2019 : for small and medium-sized companies (10 to 250 employees and turnover < € 50 billion)

- From 1st January 2020 : for micro businesses (less than 10 employees and turnover < € 2 million).

These categories are those provided by article 51 of the aforementioned law of 4th August 2008.

Please note : suppliers can nevertheless submit their payment requests via Chorus Pro before their deadline if they wish to.

CHORUS PRO : A SHARED AND FREE SOLUTION

Electronic invoicing requires using a system that guarantees the authenticity of the invoice, its legibility and the integrity of its content. The French Agency for the State Financial Information Systems (AIFE) has developed and made available for free a shared technical solution : Chorus Pro.

This Portal makes it possible to deposit and monitoring all annual invoices for the State, the local public sector (including the hospital sector) and public institutions.

The solution takes into account the diversity of public and private entities and offers a choice of transmission and reception methods.

Chorus Pro aims to :

- Put in place a simplified process for submitting and receiving invoices via a single solution

- Contributes to reduction in invoice processing times between the different relevant services

- Contribute to reduced invoice processing times at every step of the journey

- Optimize invoice tracking from its issue through its payment

- Archive invoices submitted by suppliers and validated by Information Systems

- Provide suppliers with their history of invoices transmitted via the solution

The portal manages payment requests, those of subcontractors and co-contractors and also the exchange of documents relating to the execution of works contracts.

Last Update: October 3, 2018